Understanding the Cost of Delayed Investments

By Akhil Chugh

Date July 2, 2021

काल करे सो आज कर, आज करै सो अब | – Sant Kabir

Usually, we often tend to delay investing even in the absence of any strong reasons. And we do happily think that how a few months would not matter much. But the reality is that even small delays can make a huge impact on your wealth in the long term.

The secret to being ‘wealthy’ is not always making big decisions but also making small decisions like not delaying your investments and starting right now. A few years delay in making your first investment can cause a crore worth of harm to your financial status.

The longer you delay investing, the more money it will cost you. Surprisingly, people think the cost of delaying investing is not as significant of a figure as what it truly is.

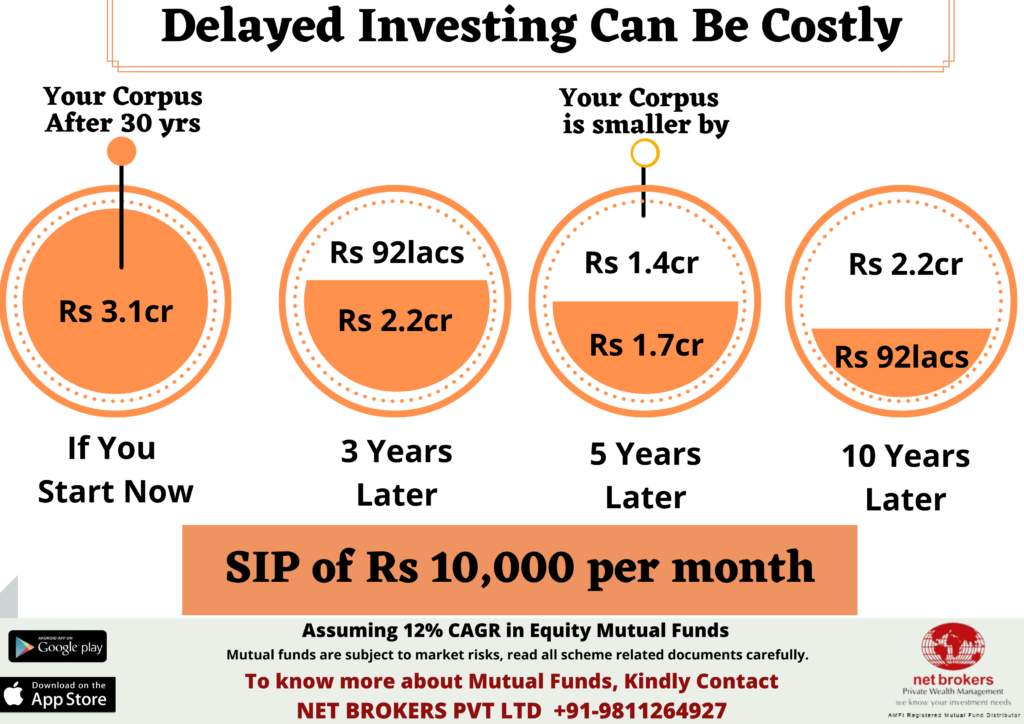

As is clear from the illustration below, how a 5-year delay in SIP can cost you over Rs 2 crores & a 10-year delay can cost you around Rs 4 crores!

The cost of delay in investing is enormous. Even one year can make a huge difference.

“Now” is the best time to begin investing for your long-term goals.

Potential reasons for delaying investments:

- Fear of making a wrong decision: There is a well-known quote that ‘known devil is better than an unknown angel.’ Some of the investors wrongly apply it to their investments as well. Thus, they end up parking their money in banks’ savings accounts or FDs earning less interest than they could earn in mutual funds which have the potential to generate inflation-beating returns.

- Information overload: Too much information is always confusing. With a lot of available investment opportunities in the market, the confusion of picking the right investment avenues is the main reason for delaying the investments especially if you are a new investor. The recommended strategy for novice investors is to start via simple products like SIPs in mutual funds and get professional help to make the right decision.

- Waiting for the right time: The market is more unpredictable than even our weather forecast apps. You can never time your investments in markets perfectly. Waiting for the market’s best days will just erode our returns in the long run. It is strongly suggested to invest regularly through the highs and lows of the market by investing through a SIP in the mutual funds aligned to your life goals.

- Too many figures: For most of us, understanding too many figures can be a tedious task. Like how to estimate the required SIP to accumulate the required retirement corpus, how much to save for a child’s higher education considering inflation, and much more. To make things simple, the Net Brokers app has all the financial calculators to make calculations easy for you. Investors can always contact us for more help.

Impact of delayed investments on wealth creation:

Becoming wealthy is a journey and investments are the highways to it. If those investments are delayed due to any reason, our dreams of financial independence will take too long to come true.

Let’s take a look at what happens to wealth creation when the investments are delayed.

Thus, the cost of delayed investments increases with each passing year!

If you start investing early, you don’t need to earn eye-popping rates of returns to accumulate big sums of money. All you need is ‘Time’. When you start investing early, your money has more time to grow due to the magic of compounding.

Start investing today & let the magic of compounding work to help you reach your financial goals!

Key consequences of delayed investments:

- Lower wealth creation:

Investments grow over time. When one starts investing early, one gets a considerable head start over others in similar situations who start late. Compound interest was referred to by Einstein as the eighth wonder of the world and rightly so. Just like investing early gives a head start, it also brings with itself the wonderous compounding effect.

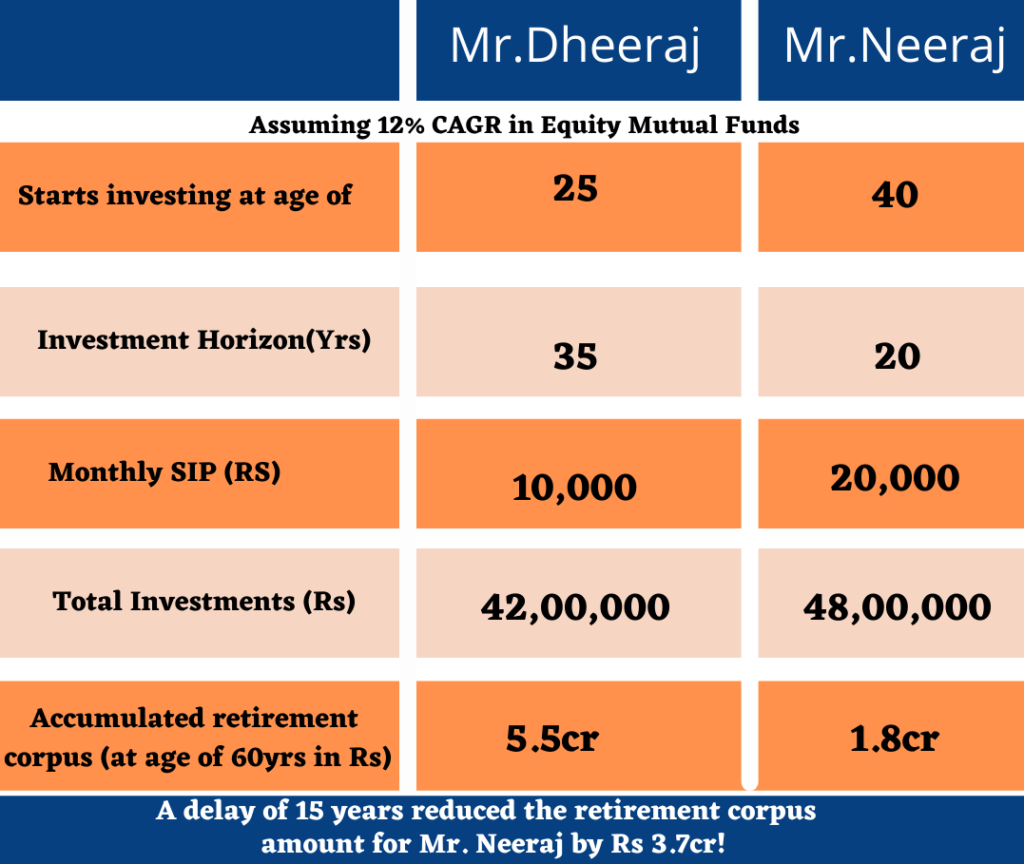

Let’s look at the illustration to understand it better. Consider Mr. Dheeraj is 25 years old and Mr. Neeraj is 40 years old. Mr. Dheeraj starts his investment journey via monthly SIPs of Rs 10,000 in equity mutual funds at the age of 25. While Mr. Neeraj starts investing monthly SIPs of Rs 15,000 in the same equity mutual funds at the age of 40. Considering the 12% CAGR returns, at the retirement age of 60 years Mr. Dheeraj will be able to accumulate Rs 5.5 crores while Mr. Neeraj will only be able to accumulate 1/3rd of Mr. Dheeraj’s corpus i.e., Rs 1.8 crores.

This is the magic of compounding. In the investment world, time is your biggest friend. Time creates money. The earlier you start, the easier it is!

2. Comparatively higher investments:

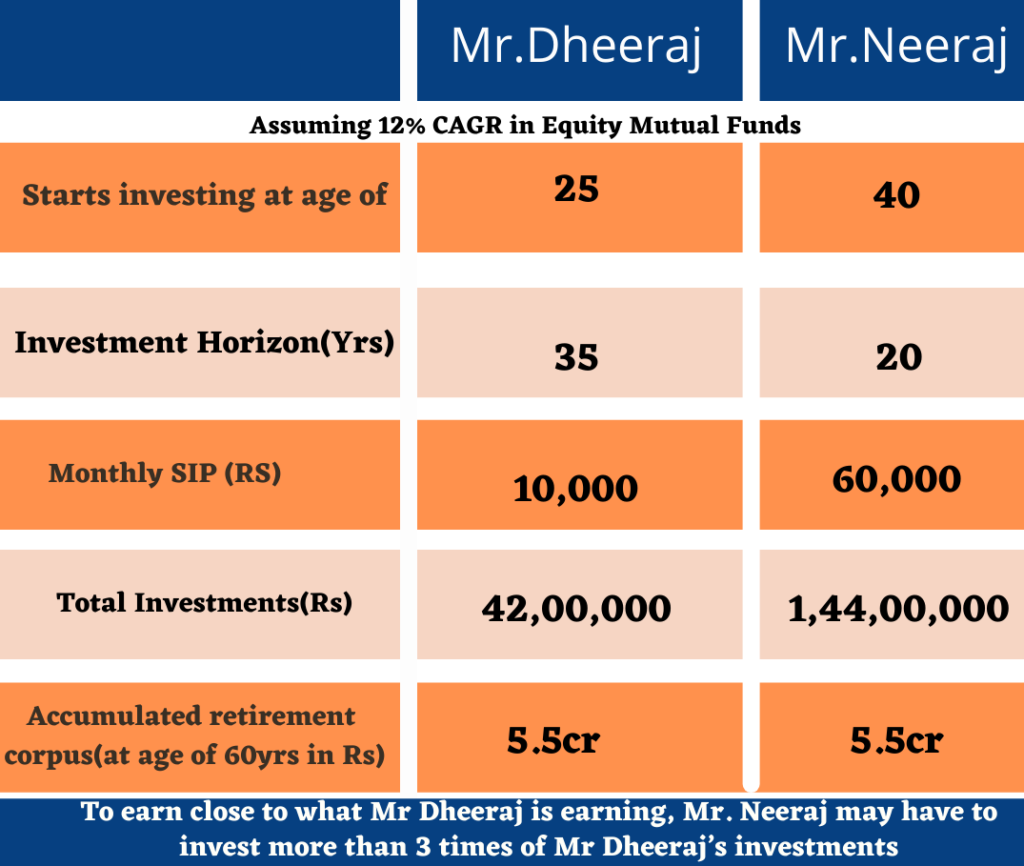

Delay in investment could cause lower returns as you lose on the magic of compounding. So, if you start late you have to invest a larger sum of money to achieve your financial goals.

Let’s understand it with the help of the above example only. If Mr. Neeraj’s retirement goal is to accumulate Rs 5.5 crore to lead a comfortable retirement life then he has to invest Rs 60,000 per month to reach his desired corpus in 20 years.

To earn the same amount, Mr. Neeraj has to make more than 3 times of Mr. Dheeraj’s investments!

3. Risk appetite & its implications:

Generally, you have a higher risk appetite at a young age when you have a longer period to stay invested as there are fewer responsibilities. With time, your responsibilities also grow like providing for your family, paying for loans, education, household bills, and expenses. Thus, impacting financial planning in the future. So, it is recommended to invest at a young age so that the returns could be higher at the time of requirements.

4. Investing vs saving benefits:

It’s good to save money but investing your savings is a prerequisite to creating wealth in the long run. Saving money in the bank accounts only gives a meagre percentage of interest while equity investments via mutual funds have the potential to deliver higher inflation-beating returns in the long run. Investing money is far better than holding it in savings accounts.

Key Takeaways from Net Brokers:

- ‘Start early to earn more. It is very important to understand the basic rule of investing that ‘time in the market’ is more important than ‘timing the market.’ The later you start, the lesser time you will give your investments to compound, resulting in lower wealth creation.

- Delay in investing can be costly. So, if you are still unsure about investing, avoid making lump sum investments and go for investment in equity mutual funds via monthly SIPs. SIPs help you to average out the cost of investing while ensuring that investors don’t miss out on any good investment opportunity when the market is favorable.

- Net Brokers strongly believes that investing money is far better than holding it in savings accounts. One cannot expect the return from a savings bank account to beat the widespread inflation. Investing in instruments like mutual funds suited to investor’s risk profile and financial goals has a greater chance of beating inflation.

There could be ample reasons behind postponing investments such as people tend to think they do not understand the market, it’s already too late or they are concerned about market volatility, etc. In reality, there is no good or bad timing.

‘Now’ is always a good time to start investing. You only need to act.

Be disciplined & have the patience to reap healthy returns as the magic of compounding unfolds over time!

For more information, get in touch with us today!

Download our mutual fund app & start investing for your long-term financial goals.

Happy investing!