Planning for your Child’s Education

By Akhil Chugh

Date February 6, 2022

“An investment in knowledge pays the best interest” – Benjamin Franklin

Each and every parent wants to give best education to their children and wishes to see them grow into intelligent, independent and successful adults. Education plays a key role in grooming your child into a responsible adult. Even though, as a parent, you may want to provide the best education for your child, rising costs of education are a major concern. Today, even primary education can cost a few lakhs per annum. In such a scenario, sending your child to a good college could be a major life expense.

For instance, a fee for PGP course in IIM Ahmedabad was Rs11.5 lakhs in 2008 and today it is Rs 23 lakhs. Similarly, IIT (B.Tech) fees was Rs 2.28 lakhs in 2008 and today it is Rs 10 lakhs.

Can you see the exponential rate at which higher education costs are rising In India?

For students aspiring to get admission in foreign universities, the cost is almost 4 times excluding supplementary charges like accommodation, travelling etc.

Cost of education is rising at a much faster rate than inflation making it important for Indian parents to plan for child education. It’s not easy to fund your child’s education if you haven’t saved enough. Especially if you start planning late!

Let’s look at some of the key points to keep in mind for a successful child education planning.

Key points for a successful Child Education Planning:

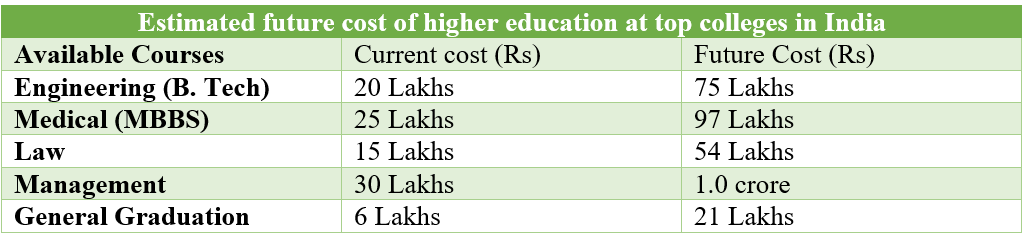

1. Know the estimated future Cost of Education:

The cost of education is increasing at a fast pace. According to rough estimates, on an annual basis the education inflation is about 10-12 percent p.a.

To estimate the size of the investment corpus required, let’s look at the cost of some popular courses in India at top institutes and assess their future cost 18 years from now, assuming inflation at 7% p.a.

Even by conservative estimate, if education cost inflation of 7 per cent a year is considered, then a 4-year engineering course that costs Rs 20 lakh at present will cost around Rs 75 lakh after 18 years. Similarly, a 2-year MBA course that costs around Rs 30 lakhs would cost around Rs 1.0 crore over the same time period. Here, we have considered the course fees for top colleges in India. The cost would be significantly higher (almost 4 times) if your education plan includes studying at a reputed foreign university.

Knowing the required corpus to finance your child’s higher education will help you understand the amount of savings that are required to be invested for child’s higher education. Thus, inculcating the habit of financial discipline in the long run.

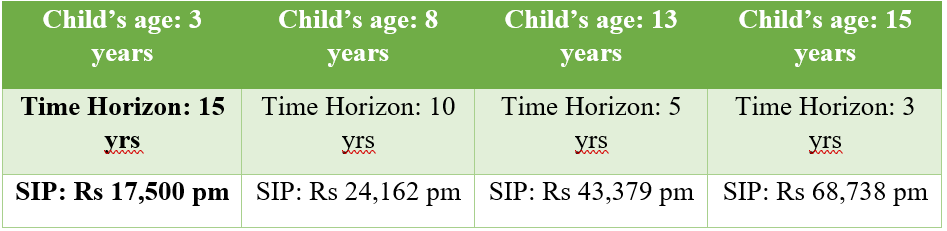

2. Start early, invest long:

If you save and invest early, you will have a longer time horizon to meet your goals and build a bigger corpus powered by the magic of compounding. Below illustration will explain how an early start can make a difference to the total corpus:

Child: Sia, Current age – 3 years

Education Goal – Engineering after 15 years

Current cost of Engineering – Rs 20 lakhs

Growth in Education cost – 9% p.a

Future cost of engineering – Rs 83 lakhs after 15 years

Assuming the annual investment yield of 12% p.a over the saving period, the required SIP amounts to achieve the desired corpus of Rs 83 Lakhs in 15 years will vary significantly depending on how early you start your SIPs.

As is evident from the first two columns of the table above, you may have to shell out almost 38% more money per month if you delay saving for your child education by just five years. So, it makes a lot of sense for you to start saving for your child future early.

3. Periodically review & rebalance your portfolio:

You should keep an eye on the portfolio from time to time to keep you on track with the target goals. Review the plan at least once a year to get an idea whether the things are moving in the right direction. Check for new ways that can help you reach your investment goals.

Investment portfolio for child education goal, when they are at least ten years away, should primarily hinge on equities as they have the potential to generate higher returns and associated equity market volatility also plays out in the long run. However, if the time horizon is less than 5 years, then debt funds are better option as they ensure safety of returns.

The investment process is very dynamic, especially if you are investing for the long term. Net Brokers suggests de-risking the funds earmarked for children education at least three years before the goal timeline by shifting money out of equities to less-volatile debt funds. Start a systematic transfer plan (STP) from your equity fund to a short-term debt fund (average maturity of 1-3 years) to safeguard your child’s money from any downturn in equity market.

4. Top-ups with rising income:

Increase the amount of investments on an annual basis. Topping up your standard investments via SIP Top-ups for financial planning for children with increasing income can help you achieve a larger fund without any burden. If you received a bonus or salary increment, you can top up the contribution by adding some extra money each month. Its good idea to invest additional funds received by children on birthdays or gifts from grandparents to the same mutual fund folio.

5. Do not stop investing

Continue your Mutual fund SIPs till you meet your financial goal. The more you delay, the more you will delay the prospects of reaching your goals on time. Even if you were to pause your monthly saving for a while, do not redeem your goal-based investment to finance other short-term needs and make sure to replenish it quickly from other sources.

Net Brokers Takeaways:

- Start investing for your child’s future as early as possible to reap the advantages of the power of compounding.

- Lump sum investing is not suggested for long-term goals. Rather start off with a systematic investment into mutual funds to beat market volatility and take advantage of rupee cost averaging.

- Gradually increase your investments via SIP top-ups with rising income so that either you can use the funds for other purposes or you can get the corpus ready earlier.

- Always review and rebalance your portfolio depending on market conditions and years left for college. We suggest parents to create a diversified portfolio for the purpose of funding their children’s education. If the years left for college are more than 5 years, a diversified portfolio consisting of large-cap equity funds and debt funds will be ideal. However, if college enrolment is less than 5 years then the portfolio should increase allocation towards debt and balanced funds.

- Seek professional help whenever required. Successful planning requires professional expertise to guide you to make an investment into suitable products as per your investment goals and risk appetite to help you reach your financial goals. Get in touch with us today.

Take the right step at the right time to make your child’s dream come true.

For more information, get in touch with us today! Download our mutual fund app & start investing for your long-term financial goals.

Happy investing.