Investing in Mid Cap Funds

By Akhil Chugh

Date August 21, 2021

Equity mutual funds can be classified into Large Cap, Mid Cap, and Small Cap funds – based on the market capitalisation of the companies they invest in. In this blog, we’ll take a look at one such mutual fund known as Mid Cap funds.

What are Mid Cap Funds?

A Mid Cap fund can be an open-ended/ closed-ended equity scheme that predominantly invests in mid cap stocks. Mid-caps are the 101st to the 250th company listed in terms of market capitalization. Mid Cap funds invest in mid-sized companies that fall between Rs.500 crore to Rs.10,000 crore in terms of market capitalization. This makes it less volatile in comparison to Small Cap funds.

A Mid Cap mutual fund must have at least 65% of its total assets invested in equity and equity-related instruments of mid cap companies.

Whether or not you invest in Mid Cap funds depends on your age, risk appetite, financial goals and portfolio allocation. There are certain benefits or pros of investing in Mid Cap funds as mentioned below:

- Mid Cap funds usually outperform Large Cap funds in the long run

- Mid Cap funds are less risky than Small Cap funds

- Mid Cap funds offer more liquidity than Small Cap funds

- Mid Cap funds invest in companies that are reasonably stable

Who Should Invest in Mid Cap Funds?

Mid-cap stocks have a reputation of being usually under-researched and under-valued and if researched well you may find stocks with the potential for growth.

Investing in Mid Cap funds is not recommended for new or first-time investors.

If an investor has high risk appetite and can commit to an investment horizon of about 7 to 10 years, this may turn out to be a good opportunity to create wealth. As an investor, if you are willing to take greater risks of exposure to volatile market conditions than as compared to a Large Cap fund, you may invest in this fund.

An investor can also look at investing in Mid Cap funds to diversify their portfolio, if the rest of the portfolio is low-risk and low-return.

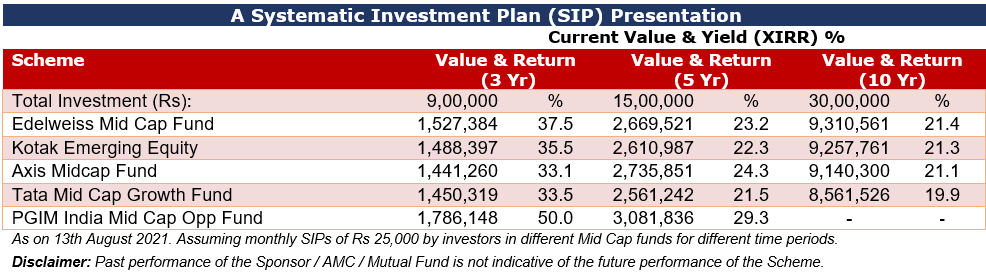

Past Performance of Top Mid Cap Funds:

Based on our analysis and research at Net Brokers, below mentioned schemes are currently the best schemes in the Mid Cap fund category. These funds fare well on quantitative and qualitative parameters and have the potential to deliver superior growth in the long run.

Factors to Consider Before Investing in Mid Cap Funds:

- Past Performance of Funds:

Before selecting a Mid Cap fund, it’s important to evaluate its performance during all phases of the market cycle. A good fund will outperform its peers not only during the bull phase but also during a bear phase. Since the mid-cap companies are relatively new or not that extensively researched, it takes a keen eye to spot the ones with potential. Mid Cap funds with good rating and consistent performance should be opted for investment.

- Investment Horizon:

To gain from Mid Cap funds, an investor must be willing to give his investments a time period of at least 7 to 10 years. Equity investments are volatile in the short run and make more sense from an investing point of view to hold for longer period of time.

- Age Factor:

The compounding benefits of Mid Cap equity funds can only be experienced with time and as a young investor with a good number of years left for retirement, you will have the advantage of age on your end. For an investor who is nearing retirement or is already retired, investing in balanced funds would be a much better option. Age is, therefore, an important factor for consideration while investing.

- Expense Ratio:

The expense ratio sums up all the costs that the fund house incurs to manage a mutual fund scheme. If the fund has a high expense ratio, then it may bring down the fund returns considerably. It’s important to select a Mid Cap fund with a lower expense ratio.

- Quality of Fund House:

As we know, mid-cap stocks are under-researched stock so while choosing the fund house it must fulfil certain criteria like an experienced in-house research team that has good coverage and techniques to manage risk, etc. The performance of the fund during both the good as well as the bad cycles must be taken into consideration.

- Risk Appetite:

The risk quotient of an equity fund varies, unlike its debt counterparts. Even within equity funds, Mid Cap and Small Cap funds are the riskiest when compared to Balanced funds. If your risk tolerance is high, you may think of investing in Mid Cap funds. Make sure that the objectives and risk profile of the Mid Cap fund is aligned with your individual objectives.

Key Takeaways from Net Brokers:

- Net Brokers believe that there is value in diversifying your portfolio away from pure large caps to include mid-caps. They have added value in return and risk terms over the longer run.

- Investors can look at adding Mid Cap funds to their portfolio for diversification and for return enhancement, although it can be limited to a certain portion of the portfolio only.

- Mid Cap Funds are suitable for investors who have a high-risk appetite and an investment horizon of at least 7 years or more.

- Finally, when you invest prefer the SIP mode to reduce the impact of volatility and benefit from the power of compounding.

Net Brokers believes that investing in Mid Cap funds is a smart way to park your funds for your long-term financial goals. Mid Cap funds are ideal for investors who want capital appreciation and wealth building, and are ready to take a measured risk in companies that have a potentially high growth trajectory.

Historical data suggests that no particular market cap can be an outperformer every year. Hence, diversification across market cap viz. large-cap, mid-cap, and small-cap is necessary. This will help lower the impact of volatility on your portfolio and thereby earn better risk-adjusted returns.

For more information, get in touch with us today.

Download our mutual fund app & start investing for your long-term financial goals.

Happy investing.