Roadmap to Planning Your Child’s Education

By Akhil Chugh

Date January 21, 2024

Parenthood encompasses a spectrum of emotions, blending joy, purpose, and meaning with the added responsibilities and financial commitments it brings. While parents naturally envision a robust future for their children, transforming those aspirations into reality requires thoughtful investments. Establishing a solid financial plan becomes the foundational ladder for meeting your child’s evolving needs.

As Benjamin Franklin wisely noted, “An investment in knowledge pays the best interest,” emphasizing the crucial role of education in securing a child’s future. Despite every parent’s desire to provide the best education, the escalating costs pose a significant challenge. With education inflation estimated at approximately 10-12 percent per annum, the financial burden is palpable.

Preparing your child for college in the current landscape necessitates meticulous planning, strategic decision-making, and judicious investments in appropriate funds and instruments. Such a venture demands a well-constructed timeline, coupled with regular reviews and recalculations along the way. Success in this endeavor hinges on the implementation of a foresighted plan.

Navigating the various milestones essential for shaping your child’s future requires a dedicated focus on planning for their education. By doing so, you not only ensure their access to quality learning experiences but also pave the way for a secure and fulfilling journey into adulthood.

In this blog, we’ll explore a comprehensive roadmap to guide you through the process of planning your child’s education.

Top of Form

Planning for your child’s future – An Illustration

Last week Sam heard his colleague, Alok, complain, about how difficult and expensive it was to get his child admitted to a good school. Alok and his wife had spent the past few months running from pillar to post to get their 3-year-old accepted at a good school. This got Sam, himself the proud father of a new born boy, wondering how much money it would take to get his son educated not just in a decent school but also through college and even perhaps post-graduation.

Sam is not alone in worrying about this. Most parents these days worry about the rising cost of education from Primary School itself, and that’s just the beginning. Higher education is expensive, and it’s only going to get more expensive. Tuition costs are rising at a rate significantly higher than the inflation rate. In fact, on average, the cost of college doubles about every nine years. This means that for a child born today, once they enter college, the college costs will be nearly four times what they are now.

So, the first question that most parents have is – How much do I need to save for my child’s future Higher Education? The follow-up question is – How do I save enough?

How much do you need to save for your child’s higher education?

As his son is just born, Sam doesn’t know his future career choice. However, that doesn’t mean he shouldn’t begin saving for his higher education. He can still plan and set a goal by estimating his son’s future education cost based on the current education cost of various available opportunities and the expected inflation rate. Every parent can and should follow this approach.

To estimate the size of the investment corpus required, let’s look at the cost of some popular courses in India at top institutes and assess their future cost 18 years from now, assuming inflation at 7% p.a.

|

Estimated future cost of higher education at top colleges in India |

||

|

Available Courses |

Current cost (Rs) |

Future Cost (Rs) |

|

Engineering (B. Tech) |

20 Lakhs |

68 Lakhs |

|

Medical (MBBS) |

25 Lakhs |

84 Lakhs |

|

Law |

15 Lakhs |

51 Lakhs |

|

Management |

30 Lakhs |

1.20 crore |

|

General Graduation |

5 Lakhs |

17 Lakhs |

Assuming an inflation rate of 7% p.a.

Here, we have considered the course fees for top colleges in India. The cost would be significantly higher (almost 4 times) if your education plan includes studying at a reputed foreign university.

The above table would give Sam an estimate of how much he will need to save for his child’s future education. On the lower side, he will need a corpus of around Rs. 17 lakhs, while on the higher side, the amount is as high as Rs. 1.2 crore. You should also remember that the structure of education fees varies from college to college. So, you should plan for a bit extra in advance to cover costs such as Hostel/Mess Expenses, Study Tour Expenses, Laptop, and other Essential study aids, etc.

Based on these considerations, for Sam a corpus of Rs. 1.9 crore (assuming Engineering + MBA as the desired career) should be sufficient to ensure that he has enough funds in the future to finance his son’s education no matter what his future educational choice is. This is a substantial amount, and no matter how big his pay check is, he will need to create a suitable investment plan for his child’s higher studies and grow his money over time to reach this investment target.

How Much Do You Need to Invest Every Month?

Start with child education planning as early as you can and invest the right amount in the right investment products to accumulate the desired corpus to fulfil all your child’s aspirations.

For Sam with a target corpus of Rs. 1.9 crore in the next 18 years and further assuming that his expected equity mutual fund investment CAGR is 12%, the monthly SIP amount he needs to achieve this target will be Rs 24,825.

This is quite a significant amount to invest only for one goal, and as a result, Sam might be tempted to not start at all and wait till he has more money to invest. However, it is not a smart idea to delay your investments as it comes with its own cost.

Delaying investment: Even higher SIP amount

It is very important to start early for the success of child education planning. Ideally, start when your child is born so that you have enough time at your disposal. The earlier you start, the more you save and, the more you save the more your money earns for you. This is referred to as the Power of Compounding.

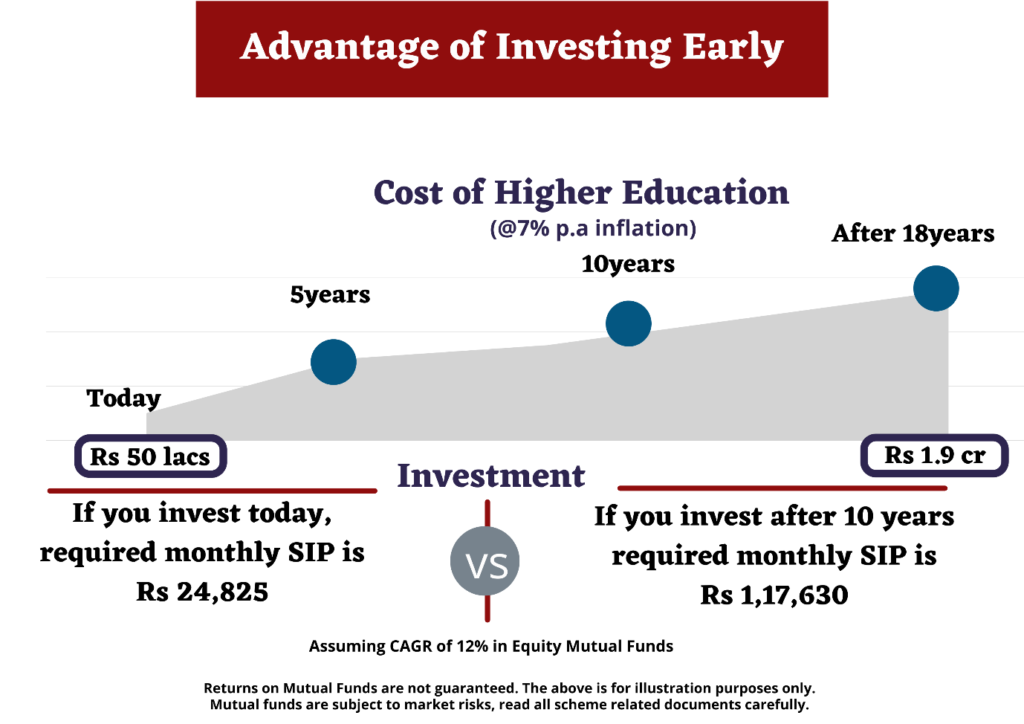

For example, if currently, the cost of higher education (Grad + Post-Grad) is Rs 50,00,000. Then the future cost of the same education assuming a 7% inflation rate after 18 years will be Rs 1.9crores and if he starts investing today then the monthly SIP required to achieve the target is Rs 24,825.

However, if he delays his investments by 5 years or 10 years, he will have to invest Rs. 50,545 or Rs. 1,17,630/month respectively.

Let’s assume that Sam decides to wait ten years before he begins investing for his child’s higher education. This delay means that he now has just 8 years to reach his investment target, so his monthly investment requirement will increase substantially, as shown below:

As you can see, waiting for 10 years means he will now need to invest around Rs. 1,17,630 every month. That’s more than double the SIP amount you would need today. So, the smarter idea is, to begin with, whatever amount you can and increase it every year.

Thus, starting early is crucial for the success of a child’s education plan.

Net Brokers Takeaways:

- Net Brokers strongly suggest starting investing for your child’s future as early as possible to reap the advantages of the power of compounding.

- Lump sum investing is not suggested for long-term goals. Rather start off with a systematic investment into mutual funds to beat market volatility and take advantage of rupee cost averaging.

- Gradually increase your investments via SIP top-ups with rising income so that either you can use the funds for other purposes or you can get the corpus ready earlier.

- Always review and rebalance your portfolio depending on market conditions and years left for college. Net Broker suggests parents to create a diversified portfolio for the purpose of funding their children’s education. If the years left for college are more than 5 years, a diversified portfolio consisting of large-cap equity funds and debt funds will be ideal. However, if college enrolment is less than 5 years then the portfolio should increase allocation towards debt and balanced funds.

- Seek professional help whenever required. Successful planning requires professional expertise to guide you to make an investment into suitable products as per your investment goals and risk appetite to help you reach your financial goals.

- ‘Never’ touch your retirement corpus to finance your child’s education because unlike your child’s education, you don’t have the option to avail of loans or receive any external assistance (such as scholarship or grants) to fund your retirement life.

“Education is the most powerful weapon which you can use to change the world.” – Nelson Mandela.

You, as a parent, have the opportunity to give this powerful tool of education to your child by planning your child’s education. Choose your investment plan for child’s education wisely and let its returns ripple through a lifetime to fulfil all your child’s dream and aspirations.

Take the right step at the right time to make your child’s dream come true.

For more information, get in touch with us today! Download our mutual fund app & start investing for your long-term financial goals.

Happy investing.